how2pr11.htm

How does Payroll Accrual Work?

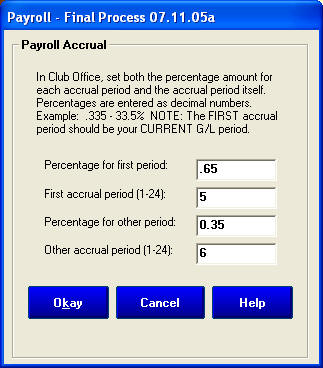

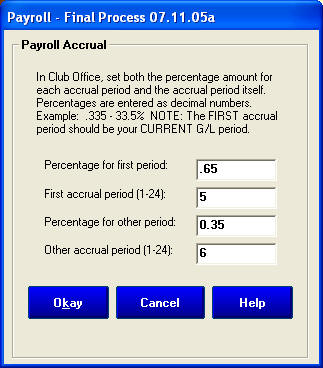

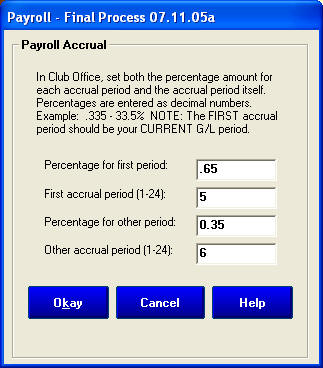

Payroll Accrual is active only during the "finish payroll" procedure. The

process creates a set of journal entries that apply to two different accounting

periods and allows splitting the values. For example, if you issue a payroll on

June 8th but some of it applies to May and the remainder to June and you want to

account for it in two different months.

- You can only accrue payroll to an adjacent accounting period, i.e. if

your current G/L period is 7, you can accrue payroll to either periods 6 or

8, but not to any other periods because they're not next to period 7.

- Accrual is based on percentages. You type the percentage to apply to the

first chosen period, and the system automatically assigns the reciprocal

percentage to the second period.

- You select which periods get which percentages.

- The journal entries are made as follows for each G/L account affected by

the payroll finish:

- The full amount is debited to the first period.

- A credit amount is posted to the first period for the equivalent

amount that is to be accrued to the 2nd period.

- The debit amount is then posted to the 2nd period for the accrued

amount.

Click here to return to the menu